Discover Wyoming Federal Credit Union: Your Trusted Financial Companion

Discover Wyoming Federal Credit Union: Your Trusted Financial Companion

Blog Article

Federal Credit Score Unions: Your Secret to Better Banking

Federal Credit Unions provide an one-of-a-kind method to financial that prioritizes their participants' financial wellness. Allow's explore the essential benefits that make Federal Credit Unions your entrance to much better banking choices.

Advantages of Federal Lending Institution

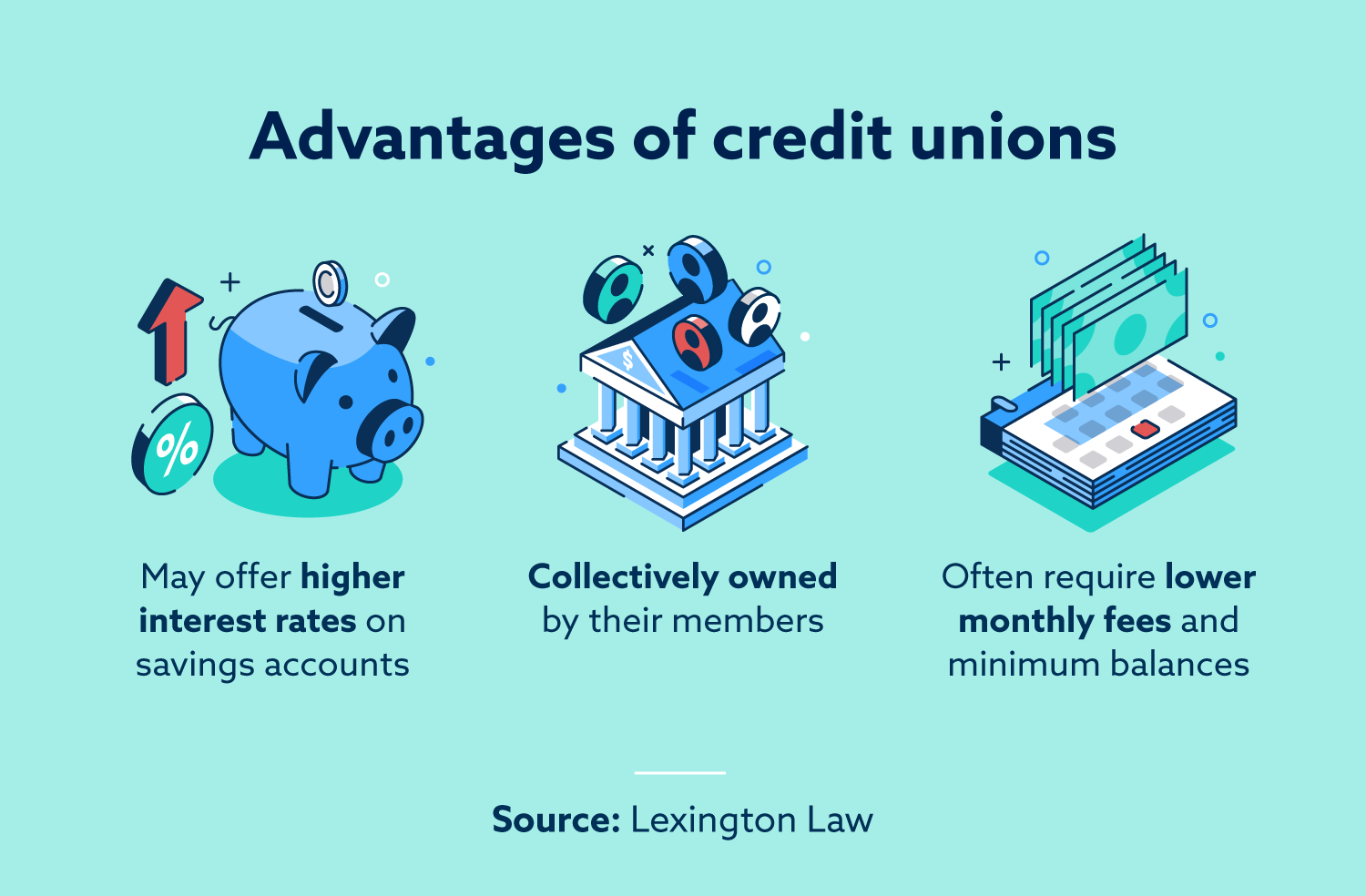

Federal Cooperative credit union provide a series of benefits for participants looking for a more customized and community-oriented financial experience. One substantial benefit is the emphasis on serving their members as opposed to taking full advantage of earnings. This member-focused strategy often translates into higher rate of interest on interest-bearing accounts, lower rates of interest on fundings, and less charges contrasted to conventional banks. Furthermore, Federal Lending institution are recognized for their dedication to monetary education and learning and counseling. Members can access resources to improve their financial proficiency, make far better choices, and job towards their long-term goals.

Federal Credit score Unions frequently have strong connections to the local neighborhood, sustaining small companies, charities, and campaigns that profit their members. In general, the advantages of Federal Credit scores Unions produce an extra inclusive and supportive financial setting for those looking for a customized and community-centered technique to fund.

Member-Focused Providers Offered

With a strong emphasis on member contentment and economic health, Federal Credit history Unions supply a varied array of member-focused solutions customized to fulfill specific demands. These specialized solutions go past traditional banking offerings to ensure that members receive customized interest and support in achieving their financial objectives. One crucial solution used by Federal Cooperative credit union is economic therapy and education and learning. Participants can gain from skilled support on budgeting, saving, and investing, assisting them make informed decisions concerning their finance. Furthermore, Federal Cooperative credit union usually give accessibility to special member perks such as affordable prices on finances, higher rates of interest on interest-bearing accounts, and forgoed fees for sure purchases. One more vital member-focused service is individualized account administration, where members can obtain customized support based on their one-of-a-kind monetary situations. By focusing on participant needs and supplying personalized services, Federal Cooperative credit union attract attention as organizations dedicated to giving superior banking experiences for their participants.

Competitive Prices and Charges

When it comes to obtaining cash, Federal Cooperative credit union typically provide reduced rate of interest on financings, consisting of auto financings, home loans, and individual car loans. This can lead to significant financial savings for members over the life of the car loan contrasted to borrowing from a traditional financial institution. Furthermore, Federal Credit scores Unions typically have less and lower charges for services such as overdraft accounts, ATM use, and account upkeep, making them a cost-efficient choice for people seeking economic services without extreme costs. By prioritizing the economic well-being of their participants, Federal Credit history Unions remain to stand apart as a trusted and cost effective banking choice.

Financial Goals Accomplishment

A crucial facet of taking care of individual funds effectively is the effective accomplishment of monetary goals. Setting obtainable and clear economic objectives is crucial for people click this to function in the direction of a safe and secure economic future. Federal credit unions can play a vital role in aiding participants attain these objectives with numerous economic services and products tailored to their demands.

One common financial goal is saving for a significant acquisition, such as a home or a car. Federal cooperative credit union provide competitive interest-bearing accounts and financial investment alternatives that can assist members grow their cash gradually. By working closely with participants to recognize their goals, lending institution can offer customized advice and remedies to assist in cost savings objectives.

An additional essential financial goal for several individuals is debt settlement. Whether it's trainee lendings, credit rating card financial debt, or various other obligations, federal credit scores unions can offer loan consolidation fundings and debt monitoring techniques to aid members repay debt successfully. By decreasing passion rates and streamlining payment timetables, cooperative credit union sustain members in accomplishing financial flexibility more info here and security.

Why Pick a Federal Cooperative Credit Union

Federal credit score unions stand out as helpful financial establishments for individuals seeking a more tailored technique to banking solutions tailored to their financial objectives and particular demands. Furthermore, federal credit score unions typically offer reduced fees, affordable interest prices, and a more customer-centric technique to solution.

Conclusion

Finally, Federal Credit Unions supply a member-focused technique to banking, giving competitive rates, individualized services, and support for attaining monetary objectives. Wyoming Federal Credit Union. With greater rates of interest on cost savings accounts, reduced rate of interest prices on finances, and fewer costs than conventional financial institutions, Federal Cooperative credit union stand apart as a customer-centric and economical choice for individuals looking for far better financial alternatives. Select a Federal Credit Union for a much more monetarily protected future

Federal Credit Unions use an one-of-a-kind method to financial that prioritizes their members' financial health. By focusing on participant demands and using personalized services, Federal Credit Unions stand out as organizations committed to providing first-class financial experiences for their participants.

By prioritizing the monetary wellness of their participants, Federal Credit rating Unions continue to stand out as a cost effective and reliable banking alternative.

Whether it's trainee finances, credit rating card financial obligation, or other obligations, government credit history unions can supply debt consolidation lendings and financial obligation administration approaches to aid participants pay off financial debt successfully (Credit Unions Cheyenne).Federal credit score unions stand out as useful economic establishments for people looking for a much more individualized technique to banking services tailored to their specific needs and economic objectives

Report this page